Binance is the world’s largest crypto trading platform in terms of volume. Binance margin trading comes with many features, and we are going to cover them all in this article.

Summary (TL;DR)

- Binance margin trading allows you to place orders of value higher than your capital.

- Margin trading at Binance comes with many features and different tiers of leverages.

- Both cross and isolated margin trading options are available at Binance.

- The candlestick chart offers its users three different chart views and also moving average.

- Margin trading has various features such as stop-limit, OCO, calculator, margin level, etc.

- You can customize the margin trading window as per your color choice and view options.

- Binance charges a high trading fee from lower VIP level users. (Use X8FX10NT invitation link to get a discount on the trading fee).

What is the Binance margin trading?

Binance margin trading allows you to trade assets on borrowed funds in the crypto market. You can open a position with a minimum margin limit and applicable leverage. All your margin orders are placed in the spot market and execute accordingly.

How does margin trading at Binance work?

At Binance, you open a position with your capital and the amount of asset you wish to purchase. Then the exchange automatically lends you the funds required to open that position based on maximum applicable leverage.

Similarly, while closing a position, the exchange automatically deducts the repay amount and other charges.

Cross margin trading at Binance

In cross-margin trading mode, the entire margin balance is shared across all open positions to prevent liquidations. Here, a positive return from one position can aid a position that is near liquidation.

However, in the case of liquidation, you are at risk of losing your entire margin balance and all the open positions.

Isolated margin trading at Binance

Isolated margin trading allows you to limit risks by allocating different positions to their margins. Hence, in the case of liquidations, instead of losing your entire margin balance, you only lose your isolated margin balance for that particular position.

Tiered leverage in isolated margin trading

The leverage for isolated margin trading is dynamic and adjusts automatically based on your borrowed funds. You can have a look at the risk ratio for the tiered leverage by clicking here.

Leverage offered in margin trading

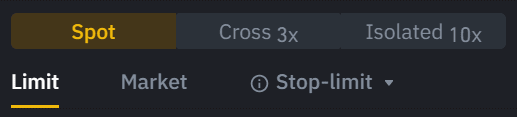

Binance offers maximum leverage of 3x on a regular account and 5x on a master account of cross-margin trading. At the same time, there is a leverage of 10x on isolated margin trading.

Binance UI: Margin trading window

The margin trading window at Binance can be classified into four parts. These different sections of the margin trading window comprise many features. So let’s have a look at them one by one:

Binance Order-book list

You can find the order book on the left side of the margin trading window. The order book is a list of orders of a particular asset at different prices, used to determine orders’ execution.

Supported trading pair list

You will find the support trading pair list on the right side of the screen. You can sort through the list based on BNB, zones, cross-margin, isolated margin, etc.

Candlestick chart

The candlestick trading chart in the center can expand, and you can view it in three primary forms:

- Original chart

- TradingView

- Depth

The chart also comes with many features such as Fibonacci Retracement, trend line, continuous drawing mode, etc.

Margin trading tab

You can find this tab below the candlestick chart. This part of the window allows to open/ close a position and posses a lot of features. Let’s have a look at those:

Transfer collaterals

You need funds to open a position in margin trading. By clicking on ‘transfer collateral,’ you can add funds to your margin trading account from your Binance wallet.

Limit

Limit allows you to place orders at a price of your choice. Limit order will execute when the market meets your order requirements. On finding a better price, you can even alter or cancel the order before executing.

Market

On placing a market order, you open/ close a position at the asset’s real-time market value.

Stop-limitOrder

Stop price: When the asset’s value reaches the stop price, your order to buy/ sell the asset at the given limit price is executed.

Limit price: It is the price at which a stop-limit executes.

One-Cancels-the-Other (OCO)

An OCO order is a combo of a limit maker order and a stop-limit order with the same quantity and on the same side. If either of the orders executes, the stop-price triggers and the other one cancels automatically.

Also, if you cancel one of the trading pairs, then the entire pair would cancel.

Binance Margin Trading: Borrow Funds

On placing an order through borrow mode, Binance automatically borrows the funds to complete your order on your behalf.

Binance Margin Trading: RepayFunds

You can use the repay mode to clear the loan amount. After completing transactions through the repay mode, Binance will automatically use the assets you receive to repay your debts.

However, you can also borrow/ repay funds manually either by clicking on the borrow button on this window or from the fund’s section.

Suppose the market goes sideways and now you are in debt. In that case, the system will not deduct the amount automatically from the user’s account. The user will have to repay the debt manually.

Binance Margin data

You can view all the assets’ margin data in isolated and cross-margin trading by clicking on the three vertical dots on the screen.

VIP Level

Binance uses a tier system that depends on your VIP level to charge a trading fee and interest rates.

Calculator icon

There is a very tiny calculator icon beside the stop-limit dropdown menu. It helps you in calculating target price, liquidation value, PNL, and ROE %.

PNL (Profit and Loss)

PNL tells the amount of return you can get by closing a position at a particular value of the asset.

ROE (Return of Equity)

Return of Equity or ROE tells the % of return you get by completing a transaction for a particular value.

However, remember that PNL and ROE’s value is an estimate and can vary depending on the interest while closing a position.

Target Price

You can enter the ROE value and other details and have an approximate price to close a trade to gain certain returns.

Liquidation Price

Your positions and their price index are used to calculate your liquidation price. You can enter your entry price, amount, and balance to get an estimate of the liquidation price.

Maintenance margin

Maintenance margin is the minimum account balance to keep a trade open. If you incur losses and your credit goes below this level, then either you’ll have to add more funds or suffer liquidation.

Margin level

You can look at your margin level by visiting the margin window from the header’s wallet dropdown menu. The meter represents the level of risk you’ve taken by borrowing the funds.

Binance margin liquidation

On the above meter, if your risk level goes above 1.1, then the exchange will automatically liquidate your position.

Customize the margin trading window

You can customize the margin trading window from the brightness button at the top right corner of the window. Binance allows you to change scheme, use light/ dark mode, change the number of charts, and order mode.

Guide to Binance margin trading

We can summarise the steps for margin trading at Binance in three broad sub-headings, which are:

Create account

You can follow these steps to create a margin account at Binance:

- Visit the official website of Binance and click on sign-up.

- Now enter your email and password and verify your email.

- Now visit the margin trading tab by hovering over trade in the header.

- Scroll down and click on activate margin account.

- Now you can transfer funds to begin trading.

Deposit funds

Now, you need to deposit funds in your margin trading account. You can follow these steps to deposit funds in your Binance margin account:

- Hover over the wallet tab in the header and click on FIAT and Spot deposit option.

- Click on the deposit button of your preferred asset.

- Now, either scan the QR code or copy the wallet address to transfer funds to your Binance wallet.

- You can also buy a crypto asset using a Visa/ Mastercard credit/ debit card from the buy crypto section.

- Now, transfer the crypto you deposited/ bought to your margin trading account.

- Click on the Margin button from the wallet section in the header.

- On the next window, click on transfer fund in front of your preferred asset.

Place an order

Now you can follow these steps to place your margin trading order:

- Visit Margin from the trade tab in the header.

- Now chose between isolated margin and cross-margin trading.

- Now customize everything that suits you best.

- Enter all the details, like price, amount, etc., and click on the buy/ sell button accordingly.

- You can look at the status of your open position at the bottom of the screen.

Binance Fees and Interest charged

Binance charges no fee for the assets’ deposit; however, you pay a fee for the assets’ withdrawal.

Binance charges a tier-based trading fee from its users. You can look up your VIP level and find your trading fee in the table below:

Binance charges an hourly interest on the funds you borrow. You can note the interest by clicking here.

If you use BNB to pay your trading fee, then you get a discount of 25%. Also use X8FX10NT referral code to get a discount on the fee.

Risks involved in Margin Trading on Binance

No matter how attractive margin trading seems, it comes with its risks. Some of the risk involved and points to consider are below:

- Margin trading is highly risky as the crypto market is highly volatile.

- Using leverage increases the risks of liquidations.

- If you have a weak internet connection, your request may reach the exchange a bit late. And by that time, the price might drop significantly.

- You can liquidize all your capital while using cross-margin trading.

- You should never leave your screen, as things can change within the blink of an eye.

- Traders can practice hedging to prevent excessive losses.

Binance Margin Trading: Pros and Cons

| Pros | Cons |

|---|---|

| Binance is the world’s biggest exchange and hence owns the best security for your assets. | The maximum available leverage is 10x. |

| The exchange offers both cross and isolated margin trading. | The exchange charges an hourly interest on borrowed funds. |

| You can buy crypto using debit/ credit cards. | Lower VIP level users have to pay very high trading fees. |

| The exchange provides a feature of auto borrow and repay. | It can be overwhelming for new users as the margin trading window is full of features. |

| The exchange offers three different types of charts. |

In Conclusion

Binance is one of the few platforms that offer both cross and isolated margin trading. It offers a lot of features that are very handy in margin trading. However, these features can be a bit hard to comprehend for beginner traders. Overall, Binance is one of the best exchanges for margin trading.

Frequently Asked Questions

Can you use leverage on altcoins at Binance?

Binance provides one of the most versatile margin trading platforms. You can use leverage not only on popular digital assets but also on highly volatile altcoins.

What does 3x mean in Binance?

It means that you are using a leverage of 3x on margin trading. Suppose you open a position of 30 USDT with a capital of 10 USDT. By using leverage, the exchange holds your 10 USDT as collateral and provides you with an additional 20 USDT to open the position.

How do I withdraw money from Binance?

You can go to the withdraw tab and then click on withdraw in front of your preferred currency. Then withdraw FIAT to your bank account.

Is it safe to leave crypto on Binance?

Binance is the world’s most popular exchange platform. Hence it is the best place to store your digital assets online.

- BYDFI Margin Trading | An Ultimate Guide [2021]

- What is Margin Trading? How does Margin Trading Work? [2021]

- 5 Best Bitcoin Margin Trading Exchange [2021]

- Top 5 crypto Margin trading exchanges 2021 | Trading on Margin

- How to buy Bitcoin on Binance in 2021?

I'm an expert in cryptocurrency trading, particularly within the realm of margin trading. My knowledge spans various platforms and strategies, including Binance, which is renowned as the world's largest crypto trading platform by volume. Here's a breakdown of the concepts and features mentioned in the provided article:

-

Binance Margin Trading Overview:

- Binance margin trading allows users to trade assets on borrowed funds, enabling them to open positions with leverage.

- Leverage amplifies the trading power by allowing users to trade with more capital than they have, potentially magnifying profits or losses.

-

Cross Margin Trading:

- In cross-margin trading, the entire margin balance is shared across all open positions to prevent liquidations.

- Positive returns from one position can help support another position that is at risk of liquidation.

-

Isolated Margin Trading:

- Isolated margin trading allows users to allocate different positions to separate margins, reducing the risk of losing the entire margin balance in case of liquidation.

-

Tiered Leverage in Isolated Margin Trading:

- Leverage in isolated margin trading is dynamic and adjusts based on borrowed funds, with different risk ratios associated with different leverage tiers.

-

Leverage Levels:

- Binance offers different maximum leverage levels depending on the type of trading: 3x on regular accounts, 5x on master accounts for cross-margin trading, and 10x for isolated margin trading.

-

Binance UI: Margin Trading Window:

- The margin trading window on Binance consists of four main sections: Order-book list, Supported trading pair list, Candlestick chart, and Margin trading tab.

- Each section provides essential features for executing trades and analyzing market data.

-

Margin Trading Features:

- Various order types are available, including Limit, Market, Stop-limit, and One-Cancels-the-Other (OCO).

- Borrowing and Repaying funds are facilitated automatically or manually to manage positions and debts effectively.

-

Margin Data and Metrics:

- Users can access margin data, margin level, liquidation metrics, and customize the trading window according to their preferences.

-

Fees and Interest:

- Binance charges trading fees based on a tiered system determined by the user's VIP level.

- Hourly interest is applied to borrowed funds, and using BNB for fees provides a discount.

-

Risks and Considerations:

- Margin trading involves significant risks due to the volatility of the crypto market and the potential for liquidations.

- Proper risk management, including hedging strategies, is essential to mitigate losses.

This comprehensive guide provides valuable insights into margin trading on Binance, covering features, functionality, risks, and best practices for traders of all levels.